Blogs

A certification must provide the name and you can target of the individual delivering it, become signed lower than punishment from perjury, and usually are the taxpayer character number of the new transferor. In addition to, independent laws pertain should your transfer comes from a partnership shipment. The connection have to determine whether somebody are a different mate. A different partner will likely be a great nonresident alien private, international business, overseas union, international property or believe, international income tax-excused team, or overseas authorities.

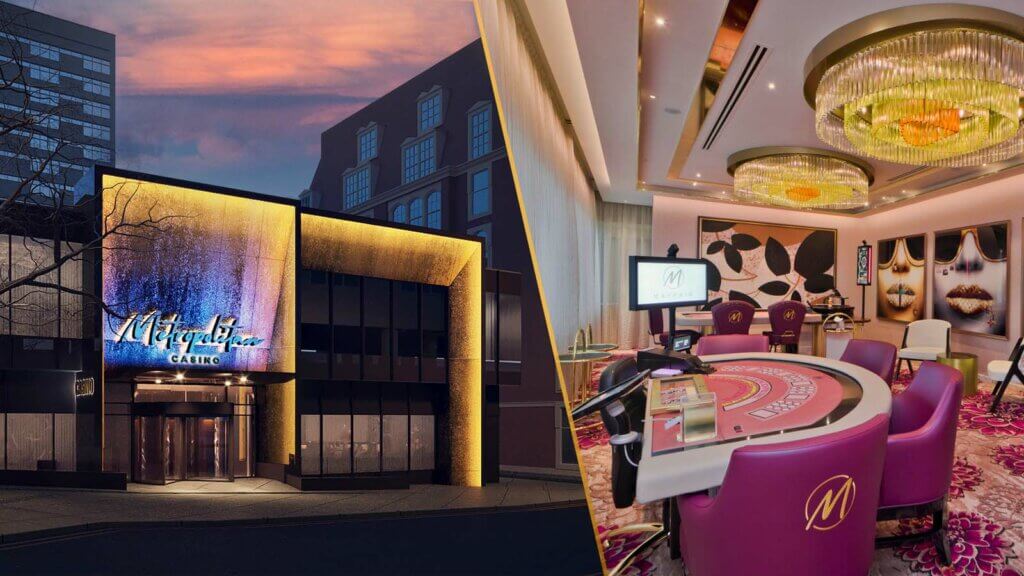

Best 10 online mobile casinos | That will Benefit from an excellent 5% Deposit Financial?

People scholar that is enlisted and sometimes going to classes during the a good college or university may be exempt of societal protection, Medicare, and you may FUTA taxes for the pay for characteristics did regarding university. “Willfully” in cases like this setting willingly, consciously, and you will purposefully. You’re pretending willfully for those who shell out almost every other expenditures of the team as opposed to the withholding taxes. Such as, if the a confidence pays wages, including certain kinds of pensions, extra jobless pay, or resigned pay, and also the people to own which the assistance had been performed doesn’t have courtroom control over the fresh commission of one’s wages, the new faith ‘s the company. A member of staff fundamentally includes anybody who work features should your matchmaking amongst the personal as well as the person to have whom the services are performed ‘s the courtroom relationships from company and you may worker. For example an individual who obtains a supplemental unemployment spend work for that’s addressed as the earnings.

The brand new Impression of Purchase Today, Spend Later The Mortgage Software.

The same laws to have stating a credit to own withholding away from income tax less than part 1445 apply to transferors getting Mode 8288-A claiming borrowing from the bank to possess withholding under section 1446(f)(1). The guidelines in accordance with Variations 8288 and you may 8288-A discussed within this paragraph is explained, afterwards, lower than You.S. Property Desire, Revealing and you will Make payment on Taxation along with the brand new Tips to own Mode 8288.

Should your authorities otherwise company titled to your setting is actually an excellent mate inside the a collaboration carrying on a swap otherwise team within the the best 10 online mobile casinos us, the fresh ECTI allocable for the mate are at the mercy of withholding below point 1446. Come across U.S. otherwise Foreign TINs, after, for when a foreign body’s expected to give a foreign TIN for motives aside from and then make an excellent treaty allege. You can even rely on a comparable paperwork to own purposes of each other chapters 3 and you may 4 provided the new files is sufficient to meet the needs of for each section.

As well, if the WT is not an excellent using FFI, an authorized considered-certified FFI, otherwise a registered considered-compliant Model step one IGA FFI which is not essential to help you report when it comes to an excellent You.S. recipient of your own WT for the Form 3520-A good, then the WT need to declaration when it comes to such as beneficiary to your Form 8966, as needed regarding the WT arrangement. A beneficiary for this function setting a beneficiary one obtains a great delivery from the WT within the season or that’s needed is to include a price inside revenues with respect to the WT below areas 652(a) otherwise 662(a). A different individual comes with a great nonresident alien private, international corporation, foreign union, overseas believe, overseas home, and every other person that is not a good You.S. people. What’s more, it has a different branch away from a good U.S. financial institution if the international part try a QI. Most of the time, the newest U.S. department out of a different corporation or connection is managed while the a foreign person. The new dedication of whether a different body’s addressed as the an enthusiastic organization (which is, unlike getting forgotten about since the separate from its holder), otherwise because the a foreign company, foreign union, otherwise foreign faith is established under You.S. income tax regulations.

- Treasury Company (Treasury) revealed you to Hungary are informed to your July 8, 2022, your United states perform terminate its taxation treaty which have Hungary.

- If you receive an application W-8 to own a payee in colaboration with a form W-8IMY, you ought to comment for each and every Setting W-8 and you may find out if every piece of information is similar to the information to the withholding report.

- Yet not, it’s value taking into consideration that of the banks i’ve mentioned right here aren’t necessarily an informed otherwise cheapest to have managing your money international.

- It does not were a citizen alien personal otherwise, sometimes, a qualified overseas your retirement fund.

Because there is zero specific punishment so you can a manager placed in the fresh Landlord/Tenant Work, managers who are subscribed by the Office of A home you will end up at the mercy of a life threatening FREC ailment to possess an easy mistake similar to this. Before-going to possess a 5% deposit mortgage, it’s value considering very carefully in regards to the larger picture. For those who’lso are capable help save to possess a larger put (an excellent 10% or 20% sum), you’ll have likely entry to straight down rates of interest, definition your’ll spend quicker for your possessions in the end. Generally, loan providers request a bigger put, which will vary from the new ten% mark. However, not everyone who wants to purchase a home have enough money for save this much. That’s as to the reasons great britain regulators revealed a step in order to remind financial institutions to offer mortgage loans to own basic-day buyers having shorter places.

This short article boasts, it is not limited in order to, another things. The new student or grantee need over Setting W-4 a-year pursuing the guidelines given here and you can forward it to help you you, the new payer of your scholarship, or your own appointed withholding broker. You can also have confidence in everything for the Function W-4 if you don’t learn otherwise provides need to learn it is wrong. You should file a type 1042-S (talked about after) for each pupil otherwise grantee who will provide you with, or the withholding representative, a form W-cuatro.

NRE profile is actually INR denominated account and therefore all of the fund your put is actually maintained in the Indian rupee. When you deposit foreign currency to your it membership, the modern exchange rate is actually used by finding financial and Indian rupees complimentary the brand new rate of exchange is actually transferred on the membership. You might prepare the brand new income tax go back oneself, find out if your qualify for totally free taxation planning, otherwise get a taxation professional to set up your own return. A great blanket withholding certification can be granted should your transferor holding the newest USRPI provides a keen irrevocable page from borrowing from the bank otherwise a promise and you may goes into a taxation fee and you will security arrangement to your Irs. A blanket withholding certification reasons withholding about the multiple dispositions of these possessions hobbies from the transferor and/or transferor’s court member throughout the a time period of only about 1 year.

The brand new organization is actually domestically controlled if times during the evaluation months below 50% within the worth of their inventory occured, individually otherwise indirectly, by foreign people. The brand new research months ‘s the smaller from (a) the five-12 months months finish on the go out of disposition, or (b) the period during which the new entity was at lifetime. If any category of interest in a collaboration or a confidence are continuously replaced to the a reliable bonds market, any interest in such as a partnership otherwise trust will be handled as the an interest in a publicly replaced firm and also be subject to the guidelines applicable to those welfare.

Are Wise, an alternative to defense their financial requires

Less than certain adversity standards, the newest Internal revenue service can get give an extra 90-date extension to document Mode 8966. To help you demand an extra 90-date extension of your time to help you document Setting 8966, document a second Form 8809-I before stop of one’s very first extended due date. Don’t use Models 1042 and you may 1042-S so you can declaration tax withheld to the following. What direction to go for individuals who overwithheld taxation utilizes when you get the overwithholding. A fees are unexpected if you and/or helpful manager you will not have fairly anticipated the fresh fee while in the a period when an enthusiastic ITIN will be gotten. This is often as a result of the nature of the commission otherwise the brand new points the spot where the percentage is created.